Updated regularly • Risk-first • No hype

Is Betronomy Legit? Real Tracking Data, Risks & What I’ve Seen So Far

If you’re searching “is Betronomy legit?” you’re probably not looking for a sales pitch — you’re looking for clarity. This page is written from the perspective of someone actively testing the system and tracking it over time. This could go to zero. My goal is to document what I can observe, what I can verify, and what you should treat as risk.

Quick answer (TL;DR)

- Legit vs safe are not the same. A platform can “work” and still be high-risk.

- So far, Betronomy behaves like a functioning system (not an obvious fake dashboard), but the outcome is unknown.

- Biggest risks: platform risk, withdrawal/operational risk, strategy changes, and regulatory uncertainty.

- My stance: I treat this as an experiment and update this page as I collect more data.

For the bigger context and rules of the test, start here: The system I’m testing (2025 case study overview).

What is Betronomy?

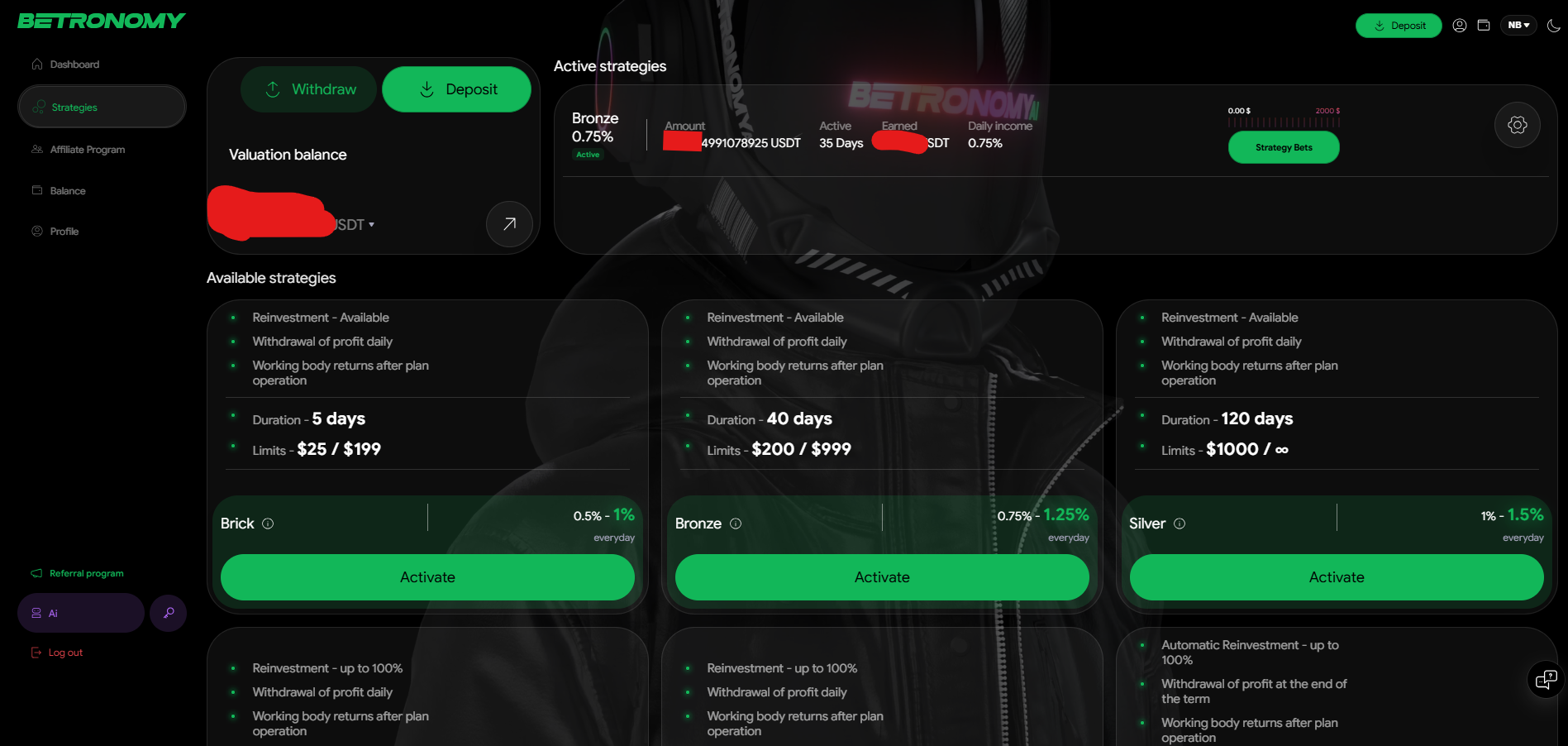

Betronomy is presented as an AI-driven system where users allocate funds to predefined “strategies” and monitor performance through a dashboard. Systems in this category can range from genuine automated execution to internal allocation models — and the honest truth is that outsiders can’t fully verify the backend. That’s why your evaluation must focus on observed behavior and risk controls.

The reason this topic attracts skepticism is simple: the internet is full of “AI income” claims. Some are real experiments. Some are marketing. Some are scams. The only useful approach is verification, not belief.

If you want broader context on how these systems typically work (and how to think clearly about them), read: Understanding Daily ROI Platforms (Plain-English Guide) .

How Betronomy Works (System Overview)

Before evaluating whether Betronomy is legitimate, it’s important to understand how the system actually operates in practice.

Betronomy is presented as an AI-driven sports betting platform that applies professional betting strategies such as arbitrage and value betting through automation, rather than manual betting or predictions.

For a clear, step-by-step explanation of the system structure, see: How Betronomy Works – Explained Step by Step .

Betronomy Risks and Red Flags

No automated betting system should be evaluated without a clear understanding of the real risks involved.

These risks go beyond individual winning or losing bets and include system dependency, long-term sustainability, transparency, and withdrawal behavior.

A detailed risk-focused analysis is available here: Betronomy Risks and Red Flags – What You Should Understand .

Common Questions About Betronomy

Many readers researching Betronomy ask similar questions about how the system works, what risks exist, and what expectations are realistic.

To address these clearly and directly, see the full FAQ: Betronomy FAQ – How It Works, Risks & Common Questions .

Why people ask “is Betronomy legit?”

Searching “is Betronomy legit” usually means you’re trying to avoid the same classic outcome: a platform that looks fine for a while, then withdrawals slow down, rules change, or it disappears. That caution is rational.

- Automation/AI claims: easy to market, hard to prove.

- Daily performance reporting: can be real, but also easy to manipulate.

- Referral structures: not automatically bad, but frequently abused.

- Limited public history: newer systems have less time-tested credibility.

This article supports your “legit” evaluation directly: 5 Signs a Passive Income Platform Might Fail (and how to protect yourself) .

My tracking method (what I measure and why)

Most “reviews” are useless because they only talk about profits. I track behavior and reliability — the things that typically break first if a platform becomes unstable.

- Consistency of reporting: does the dashboard behave logically over time?

- Changes in strategy behavior: sudden “perfect” performance is a red flag.

- Operational stability: downtime, delays, unexplained changes.

- Withdrawals: not just “can you withdraw once,” but can you do it repeatedly?

- Risk narrative: do they acknowledge risk or only promise upside?

Full explanation + examples: How Daily Tracking Works (With Real Examples) .

What I’ve seen so far (Day 78)

At the time of writing, I’ve been tracking Betronomy for 78 days. This is not a guarantee — it’s a reference point. The goal is to document reality as it unfolds, not to sell a dream.

What looks normal (not proof it’s legit, but expected)

- Performance fluctuating (up and down).

- Different strategies performing differently.

- Short-term wins followed by normal pullbacks.

What I watch closely (common failure points)

- A sudden shift to “perfect” results with no volatility.

- Withdrawal slowdowns, changing rules, or vague delays.

- Heavy pressure to recruit instead of improving transparency.

- Frequent resets that erase performance history.

If you want the “how yield is explained vs how it can be misunderstood,” read: Algorithmic Yield Explained.

Risk checklist: red flags vs normal behavior

If you want to answer “is Betronomy legit?” responsibly, you need a checklist that focuses on failure modes. Here’s the one I use.

Normal (not proof, but common in real systems)

- Clear terms, consistent reporting, and visible volatility.

- Support that answers concretely (not “just trust the process”).

- Performance that includes both up and down periods.

Red flags (high-risk signals)

- Guaranteed returns or “risk-free” language.

- Withdrawal issues, rule changes, vague delays.

- Pressure tactics (“get in now”, “last chance”).

- Recruitment emphasized more than product transparency.

- Frequent history resets or disappearing performance records.

For the full evaluation model: Evaluation Framework.

Who should avoid Betronomy (even if it’s “legit”)

Even if something isn’t an obvious scam, it can still be a bad decision. Here’s the honest filter:

- If you can’t afford to lose the capital, don’t do it.

- If you need guaranteed monthly income, don’t do it.

- If you don’t understand platform/counterparty risk, don’t do it.

- If you’re emotionally chasing losses or “the next big thing,” pause.

If you want a structured way to evaluate this over time: 30/60/90 Review Plan.

Verdict: is Betronomy legit or a scam?

Here’s my honest position based on what I can observe:

Betronomy currently behaves like a functioning system, and I haven’t seen the classic “obvious scam dashboard” pattern. However, this remains a high-risk experiment. Outcomes can change fast. The only responsible approach is risk management.

The most important sentence on this page: Legit does not mean safe. A platform can operate normally for months and still fail later. That’s why I focus on behavior, withdrawals, and transparency over time.

Disclosure: This site may include referral links. If you choose to use them, it can support my tracking work. Nothing here is financial advice — it’s documentation of a real-world test.

If you decide to explore it yourself

I’m not recommending this as “safe” or “guaranteed.” I’m documenting an ongoing test. If you still want to explore Betronomy on your own, you can use the link below (optional).

Visit Betronomy → (Referral link)

Note: Referral links may generate a commission at no extra cost to you. This helps support ongoing tracking and updates.

Want the full case study context?

Start here: The System I’m Testing (2025 Case Study Overview) — it explains the rules, what I track, and what I don’t assume.

FAQs

Is Betronomy legit?

Based on ongoing tracking, Betronomy behaves like a functioning platform, but it remains a high-risk experiment. “Legit” does not mean “safe.” The responsible stance is to treat it as speculative and manage risk accordingly.

Is Betronomy a scam?

I haven’t seen clear signs of an outright scam pattern so far, but platform risk remains. Some platforms fail later due to operational, regulatory, or liquidity issues — which is why ongoing monitoring matters.

Can Betronomy go to zero?

Yes. Any platform in this category can fail, shut down, or become inaccessible. Only risk money you can afford to lose.

What should I check before using a platform like this?

Focus on failure modes: withdrawals, rule changes, pressure tactics, unclear fees, and frequent history resets. Use a structured evaluation approach: Evaluation Framework.

Updates log

I update this page as the test continues. It prevents “static review” bias and makes the page more useful over time.

- Day 78: Page published + baseline observations documented.

Related reading on BetatSports

- The System I’m Testing (2025 Case Study Overview)

- How Daily Tracking Works (With Real Examples)

- AI Income Systems in 2025 – Full Guide

- 5 Signs a Passive Income Platform Might Fail

- Understanding Daily ROI Platforms (Plain-English Guide)

- 30/60/90 Review Plan

- Algorithmic Yield Explained

- Evaluation Framework